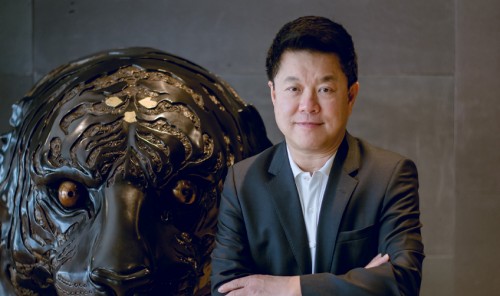

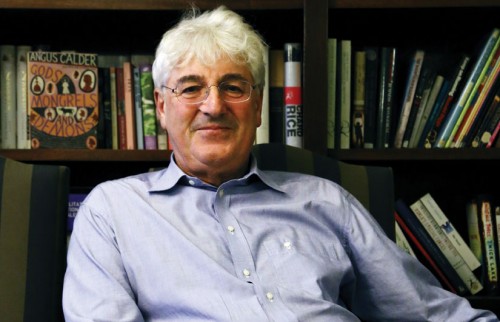

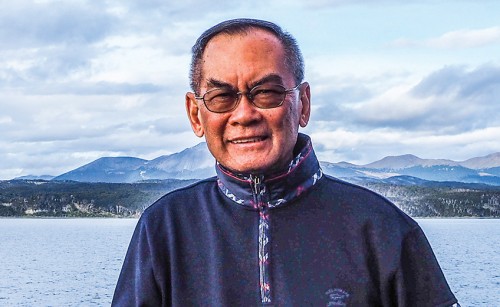

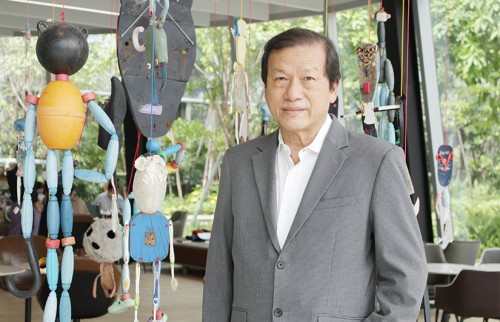

Chen Namchaisiri is the newly elected chairman of the Federation of Thai Industries (FTI), a trade council founded by local industrialists and manufacturing companies. He won a unanimous vote from members — something quite unusual in an FTI election, as it has a history of factional voting.

The FTI is an influential trade organisation that assists local industrialists and Thai factories and companies in their business ventures. It is like a club where businessmen and industrialists come to cultivate a network and find matching investors. It also serves as bridge between the private sector and government. The FTI also helps lobby authorities or provides assistance in legal or policy disputes. Thus each industrial cluster wants a chairperson to represent its particular interests. The overwhelming vote for Mr Chen signifies a change at the FTI, perhaps a change within Thai industry itself.

“Perhaps members know me and are familiar with my face,” Mr Chen explained humbly, in an exclusive interview with Elite+. “I have been helping the FTI committee promote energy saving and clean technology for 20 years. I have visited members at factories to help them improve energy efficiency. So members of the FTI know my face.”

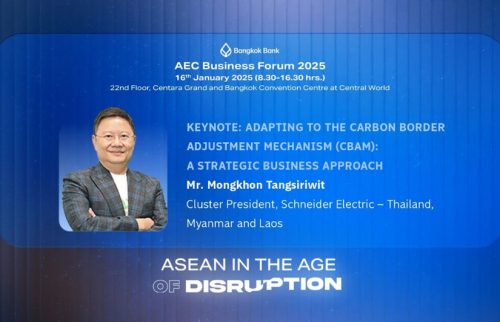

More important to him is that Thai industry is facing perhaps its biggest challenge. The industrial sector that helped catapult Thailand into one of the tigers of the new industrialised countries in the 1980s must find a new way forward. Thailand no longer gets rich from petrochemicals like it did in the late ’80s and ’90s. Foreign investors have moved production bases such as textile factories to Myanmar or Cambodia. Hi-tech and electronics companies have moved factories to more technologically advanced countries such as Singapore or even rising Vietnam. Thailand’s manufacturing is no longer cheap, and the level of skill and technology in production is also not very advanced.

The world economy has stagnated. The US and European Union have yet to recover. China — a major trading partner — has seen its double-digit GDP growth cut in half.

But the worst hurdle turns out to be innovation, especially digital innovation, which disrupts established industry.

Online content has forced many newspapers and magazines to close down. Electronic vehicles such as Tesla or even electronic BMW sports cars may spell doom for Thailand’s automotive industry, once the “Detroit of Asia”. Solar energy or even nuclear fusion might spell the beginning of the end of Thailand’s petrochemical-based industry.

Fearful businessmen might call it the sunset of traditional factories. But Mr Chen appears nonchalant. “It is a tough time because local industry has big challenges ahead. Thai industry is losing its competitiveness. Industrial export performance is no longer bullish. So it is about time we modernised our industry ... moving from the 3.0 version to 4.0.”

“Thailand 4.0” or “Industry 4.0” are new buzzwords. Prime Minister Prayut Chan-o-cha has used them. Trade ministers and businessmen talk about them. But what do the terms mean? How does the newly elected chairman of the FTI plan to modernise Thai industry?

“Industry 4.0 is about marrying production with information and digital technology,” he said. “It is about putting the industrial manufacturing process, from design, production, warehousing, logistics, marketing and even billing into the new digital ecosystem.”

Mr Chen is president of Asia Fiber PCL and recipient of master’s degrees in mechanical engineering and in industrial engineering from Stanford University in the US.

The FTI comprises over 10,000 industrial companies. Most of them date from the pre-digital era, types of companies that use stand-alone factories to mass produce identical products. Many are reluctant to change.

“Some factories are resistant because they still believe their machines can produce. But it is not enough to think only about capacity or production. They should think about why they produce and is it worth producing? Is it profitable to produce?”

Thai companies are at a crossroads. The era of simple mass production has gone. “We need to think of design, innovation and using intellectual property to improve our products. Personally I think Thailand is no longer suited to be a mass production base. We need to move forward to create customised products using our creativity.

“Factories cannot just wait for customers. They need to have better innovation, design and uniqueness. Thai industry must produce for niche markets. Sales volume might be less but the price per unit will be higher.”

Times change. As does the export market. Mr Chen believes former markets such as the US and Europe are no longer as viable because they are enmeshed in their own economic problems. More lucrative markets may be China, Japan and ASEAN. China, despite GDP growth receding from double digits to 6%, is still a good market if Thai companies can find potential buyers and respond to consumers.

“The Chinese trust and value Thai brands. But Thai businessmen need to understand that Chinese consumers have changed too. They are no longer a poor country. They have a bigger middle class and fewer low-income earners. They are looking to luxury and niche products and that is the sector Thai manufacturers need to explore to find out what products they need.”

Mr Chen has action plans for the FTI. He is going to create new industrial clusters, such as an alternative energy cluster, agro-industrial sector, food industry sector and material sector.

“I think our industrial sector must have the opportunity to work and help local farmers. Industrial technology must help the added value of farm products. The era of Thailand selling mass-produced goods or raw farm products at cheap prices is over. Industry and the farming sector must work handin-hand to add value and uniqueness to products.”

For example, Mr Chen will propose that factories sign contracts with rubber farmers to supply raw materials for value-added products such as tyres and gloves. In the old days, the rubber processing industry faced a supply problem. Factories chose to buy raw materials when they could get a better price. Contracts that fix supply and price will help factories have better access to materials.

Changing attitudes will be important for Industry 4.0. “Our local businessmen, especially small and medium enterprises, are often afraid of the AEC. They fear opening border trade among ASEAN countries will lead to more foreign competition. They need to think in reciprocal terms. Other countries need to open the door to Thai companies too. We also have a chance to access their markets.”