Tariff War Repercussions on US Economy

A first quarter report by the US Commerce Department confirms a prediction of economists that the US economy will contract after Trump’s tariffs announcement. The country’s first quarter gross domestic product (GDP) between January and March, fell at a 0.3% annualised pace, according to the Commerce Department’s report, which adjusted for seasonal factors and inflation. This was the first quarter of negative growth since Q1 of 2022.

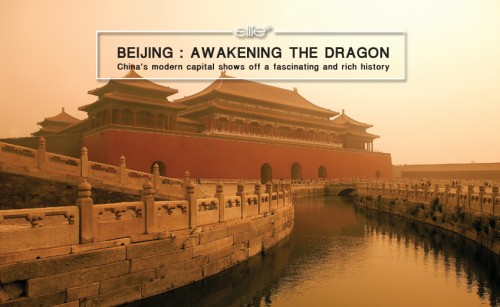

In contrast, China’s economy moved in the opposite direction. According to data released by the National Bureau of Statistics on April 16, China’s gross GDP reached RMB 31.88 trillion (USD 4.40 trillion) in the first quarter — marking a 5.4% year-on-year increase in real terms, exceeding market expectations of 5.1% growth forecasted by many analysts.

However, the US GDP only provided cross signals for the Federal Reserve ahead of its policy meeting next week. While the negative growth number might push the central bank to consider lowering interest rates, inflation readings could give policymakers pause. The Fed though actually prefers the personal consumption expenditures (PCE) price index, which posted a 3.6% gain for Q1, up sharply from the 2.4% increase in last year’s Q4. Excluding food and energy, core PCE was up 3.5%. Fed officials consider the core reading a better gauge of long-term trends.

A related reading known as the chain-weighted price index, which adjusts for changes in consumer behaviour and other factors, rose 3.7%, well above the 3% estimate. The Commerce Department also reported that the PCE price index in March was little changed. The headline annual inflation reading was 2.3% for the month, slightly higher than expected, while the core was at 2.6%, as forecasted, which showed consumer confidence in the short run.

However, an analysis from the independent Yale Budget Lab reckons tariffs will cost the average household USD 3,800 in 2025, with a disproportionate impact on clothing and textiles, with prices likely to increase by 17%. Trump’s sweeping new tariffs, on top of previous levies and retaliations worldwide, are expected to increase prices for everyday items. The trade wars have already roiled financial markets and plunged businesses into uncertainty, all while economists warn of potentially weakened economic growth and heightened inequality.

Experts also warn that the proposed tariffs could escalate inequities. Low-income families in particular will feel the costs of key necessities, like food and energy, with fewer savings to draw on, which could significantly strain budgets. Low-income households often “spend a larger share of their income on essential goods whether it’s food or other basic products, like soap or toothpaste,” said Gustavo Flores-Macías, a professor of government and public policy at Cornell University whose research focuses on economic development. Because of this, he said, even relatively small price increases will have disproportionate impacts.

Furthermore, these immediate price increases will be passed on to consumers, basically as soon as retailers have to buy new products. This is going to affect everything in the economy by an average of 1.2% and an average tax increase of $1,243 per US household in 2025, said Josh Stillwagon, an associate professor of economics and chair of the Economics Division at Babson College. These estimates of reductions in after-tax income may understate the harm to consumers in loss of choices as tariffs reach prohibitive rates.

While the economy is still adding jobs and consumers are still spending, the GDP report raises both the danger of recession and the stakes for Trump as he negotiates deals with U.S. trading partners. The traditional rule of thumb for recession is two consecutive negative quarters, though the official arbiter, the National Bureau of Economic Research, uses a definition of “a significant decline in economic activity that is spread across the economy and lasts more than a few months.”

In addition, US agricultural exporters could be very affected. The United States sells more soybeans to China, by value, than any other single product. Last year, that amounted to more than 27 million metric tons, worth USD 12.8 billion, or about 9 cents of every dollar of goods the United States sold to China. Trump’s first trade war with China from 2018 to 2019 resulted in billions of dollars of lost revenue for American farmers.

While about 15% of US farm exports went to China in 2024, the soybean sector, in particular, now stands to lose big because China is its largest export market. When Trump imposed tariffs on Chinese goods in his first presidential term, Beijing retaliated by buying soybeans from other countries, like Brazil. It also imposed retaliatory tariffs of its own. This time around, those tariffs are five times higher. Furthermore, Beijing failed to meet obligations for US agricultural purchases under a 2020 trade deal signed with Trump before, according to the Census Bureau.

The US has more than 500,000 soybean producers, according to the Department of Agriculture’s Census of Agriculture. That includes at least 223,000 full-time jobs supported by the soybean industry, according to a 2023 report by the National Oilseed Processors Association and United Soybean Board. The industry is worth USD 124bn in the US. Corn and pig farmers have also been urging the Trump administration to step back from its tariff spat. Cargill, Archer Daniels Midland and Tyson Foods are three of several large US food companies that will likely lose export earnings from China.

The American Soybean Association has publicly opposed Trump’s tariffs on China, and soybean farmers have warned that many in the industry could go out of business if the trade war continues.

Trump's Republican party enjoys wide support across the US farm belt, where he won most states in the November election. Farmers typically back him even though the US agriculture sector was one of the hardest hit during the US-China trade war that Trump fought during his first administration. Still, farmers who are affected most said they think a new dispute with Beijing would be short lived and less economically painful.

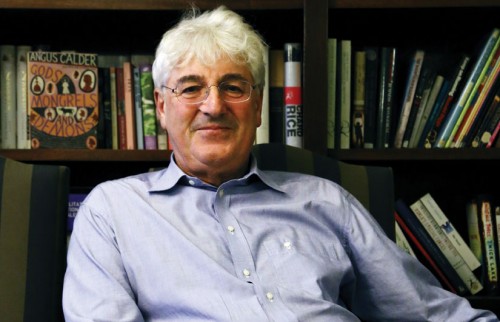

Kamol Kamoltrakul 48 Posts

Visiting lecturer: Navy Academy Institution, NIDA, School of Governor, Ministry of Interior, Chulalongkorn University, Former Lecturer, ABAC Honorary Advisor Trade and Industry Committee Senate. Senior advisor, Standing Committee on Finance and Banking, The House of Representative. Former Advisor to the Minister of Interior Board Member of ThaiPBS Board Member Of Thai Consumer Council Columnist : Prachachart Business Weekly, Matichon Weekly, Khom Chad Luke Daily Former Program Director Asian Forum for Human Rights and Development ( FORUM-ASIA).