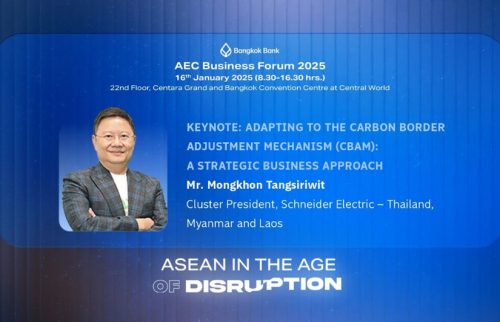

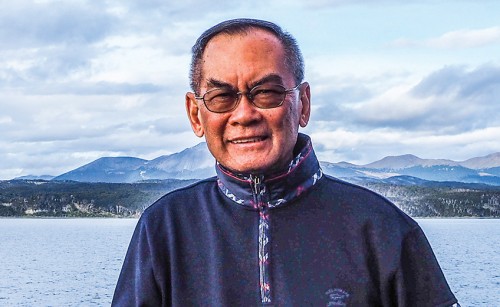

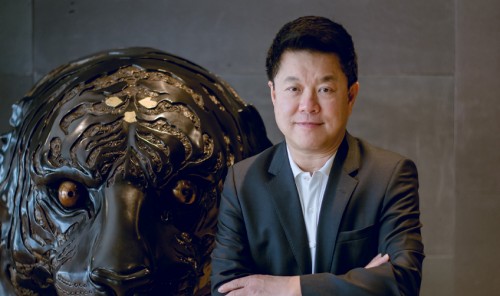

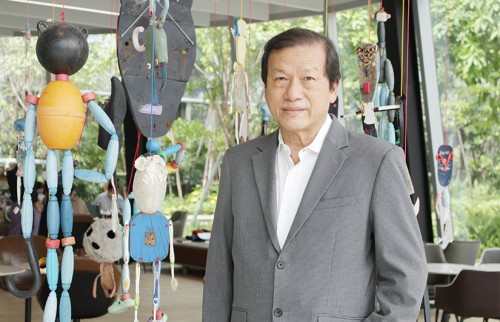

Elite+ sat down with Chatri Sophonphich of Bangkok Bank for a rare interview on the company’s history of success, business model and long-term strategies, and the likely effects of the coming ASEAN Economic Community on the region’s banking sector.

E+: What factors contributed to Bangkok Bank’s history of success?

Chatri: The president before me was Boonchu Rojanastien, who left the bank to be deputy prime minister and finance minister during the administration of General Prem Tinsulanonda. I was appointed to replace him as the new president on March 13, 1980.

To be given the trust and confidence to take over such a position was a great honour. But to be honest, I was a little nervous. The future of the bank wasn’t in doubt, because the whole team from Mr Boonchu’s time was still there, and capable young staff had started to move up the command chain and shape the firm’s progress. But all this was around the time of the end of the Vietnam War. General Prem became Prime Minister, and many pro-communist Thais who had fled into the forest came back and turned themselves in. The price of oil was high, but eased over the course of the year. The overall situation was calm and stable. The economy was on the rise. The government was reliable. The bank had a new president, and a new head office. We moved from our former head quarters on Phlap Phla Chai Road to the new building on Silom Road. For me this period would become a big turning point for Bangkok Bank.

We decided to launch a new marketing policy. The prime objective was to achieve dominant market share both locally and internationally, and as quickly as possible, under the slogans “Puenkoo kid mitrkoobaan” (Your partner and trusted family’s friend) and “Rao tong pen ti nueng” (We have to be number one). From the deposits of 1 billion baht, we challenged the branches to meet a target of 2 billion baht, then to 10 billion baht, and branches that achieved the targets were handsomely rewarded. We worked very hard but also enjoyed our jobs. On Saturdays and Sundays staff members would meet up and walk the streets to promote the bank’s services and look for customers. Our new marketing strategy was amazingly successful, especially during the first five years, before we toned it down to steady our growth. I was in the position for 12 years, from 1980 to 1992, and Bangkok Bank expanded in every respect: 12-fold, or 1,200 per cent, in terms of net profit; seven times more in authorized capital; a six-fold increase in loans and deposits; and a five-fold increase in overall assets.

E+: What’s your secret to manageria lsuccess?

I don’t think there is any secret at all. What I did was actually quite simple, and not much different from those of other successful executives in banking, or other businesses. There are three main factors: Firstly, you need a good team behind you. No matter how good you are you can’t handle the big job alone. You need a talented, capable team to brainstorm and execute the plans.

Banking is fairly simple. You take deposits, make loans and provide financial services. So banking is all about service and marketing. A bank,like any company, needs good employees to be successful. You have to be aware of your weaknesses and acknowledge that there are lots of people out there who specialize in certain areas that you don’t. You need these people. Recruit them. Convince them to come and work with you.

When the bank first started, we had many internal problems, some of them critical. Mr. Boonchu was invited to help fix these problems, which he did very well too. Later on he brought in several experts from various fields to form an efficient team for the bank.Once you find these people, once they agree to work with you, you need to take good care of them. Assign them tasks that allow them to realize their potential. But you must set up rules for team work and coordination. Everyone must move, communicate and work for a common goal as a team. Problem solving may, at times, entail some conflicts. When conflicts occur, you have to handle them honestly and without bias, and in time everyone will accept this kind of working environment.

Bangkok Bank has faced many problems in the past, some of which could have brought the bank down.For example, we had a serious case of internal corruption during the first few years of our formation. The coup by Field Marshal Sarit Thanarat caused major political turmoil. We had a “crisis of rumour” when many of our good customers with drew money from the bank in panic. Then there was the “Tom Yum Kung”financial crisis of 1997 that badly shattered all economies of Asia. We managed to get through these heart breaking incidents fairly well thanksto our capable and hard-working management team.

Secondly, the second most important factor is the well-being and spirit of the employees at all levels. Every one of them counts. These employees are the ones that deal directly with our customers. They are the actual service providers on the front line. They are the ones who ensure the bank’s survival and dictate the rate of growth.We have to respect their significance and contribution. The board and I care very much about, the morale and well-being of our employees.

During the time of my presidency,our staff had the highest salaries and the best benefits among most companies in Thailand. When we issued new shares, we allotted some to employees. We involved them in the company ownership. Our employees were also our share holders. We often launched new campaigns to raise deposit funds and lift service standards, and those who did well were rewarded. Bangkok Bank was the country’s fastest growing bank and our staff were proud to be part of this. Our employees were also our shareholders. We often launched new campaigns to raise deposit funds and lift service standards,and those who did well were rewarded success.

Last but not least, customer trust and confidence were always our top priority, because we are dealing with their money. Trust and confidenceare a result of honesty and consistency.We stood by customers in good times and in bad times. Since the economy was never stable, moving up and down, so did the business. Those who fell were not out. Most of our customers had financial problems at times, however we continued giving them support, especially those who were determined and honest. Many of our smaller customers flourished and became millionaires due to our financial support, including many customers from overseas such as in Singapore, Malaysia, Indonesia and Hong Kong. Once the problems eased and business improved, they were deeply grateful to us and spread the good word. This was why we had many loyal customers all over the world, without much advertising.

For our early Thai customers, doing business with foreign countries was anordeal. International banks had strict rules that were not well understood by unsophisticated and less educated customers and merchants. Communication was a problem. Bangkok Bank understood the problem well and helped them out as much as possible.We explained the facts and what couldbe done. When dealing with imports or exports, we translated important documents from English to Thai,helping out with foreign contacts,written correspondence and providing financial support. Their businesses grew and they remain our valued customers to this day. That was anAsian way. Not many Western banks understood this mentality. We couldsay we understood Asian customers better and offered better assistance, so naturally they preferred us.

Today our customers are better educated and knowledgeable, and in many cases they know something better than we do, therefore the style and focus of our services may be different but the essence remains more or less the same. That is to offer the greatest convenience and efficiencyto all customers. If they come in and find lots of complications and tedium,say in a loan application or other financial matter, they won’t come back, because nobody wants to waste time. It’s our job to give them what they want and work harder to make banking and services convenient for them.