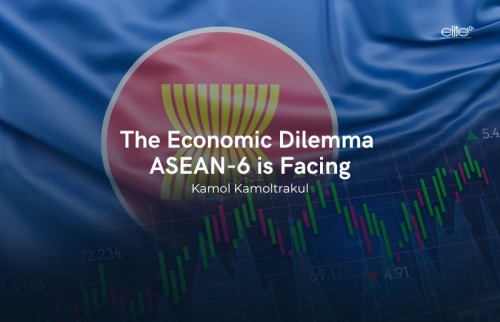

The world is reaching another watershed moment. Brexit, the rise of right-wing politicians in Europe and the recent outcome of the US presidential election point to a direction that is more inward, more nationalistic – a trend which may affect AEC exports and derail international trade agreements.

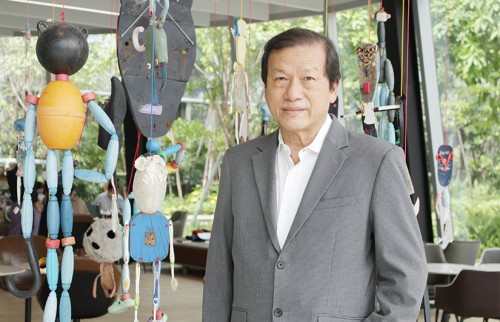

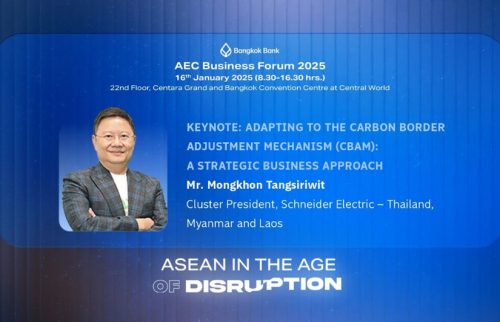

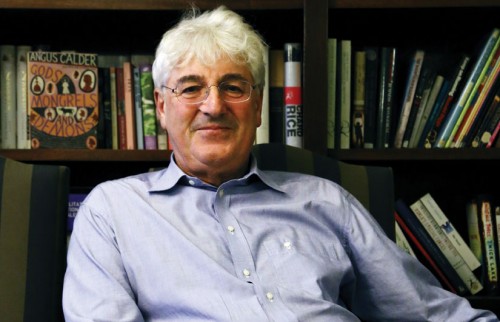

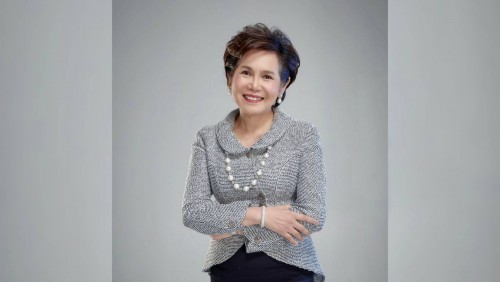

The economic situation in Thailand is nothing to celebrate, according to Taweelarp Rittapirom, executive vice-president of Bangkok Bank, speaking at a forum to mark the second anniversary of Elite+.

“Thailand is standing at a crossroads,” he said. “If you follow news and updates either from the World Bank or Asia Development Bank, you realize that our export rate starts to decline. The country needs to come to terms with the fact we might not be able to depend on our export sector like we have been. Local spending falls flat while the farm sector does not perform so well. Currently only the tourism sector can continue to grow.”

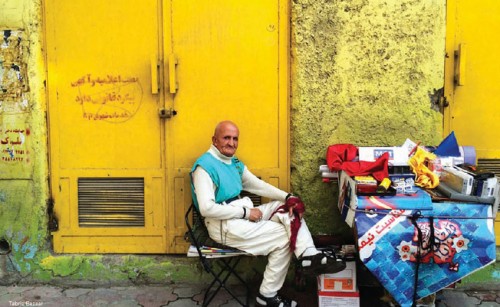

The forum on the economy was hosted by this magazine. Shoke Na Ranong, executive vice-president and manager of the credit card division at Bangkok Bank PCL, also shared information on Prompt Pay.

Thailand is no longer a major manufacturing hub of the region, said Mr Taweelarp. Foreign investors have moved to countries with lower labour costs such as Vietnam, Cambodia and Myanmar. Meanwhile, foreign investors from the EU will not return to Thailand until the country has a democratically elected government.

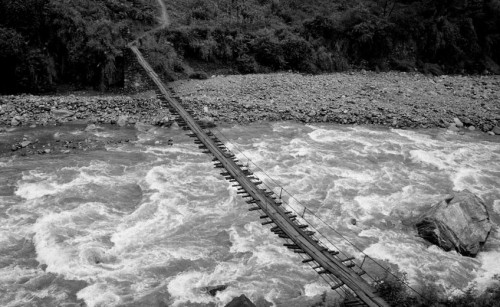

The government has many challenges to overcome. The first is to make sure its plan to inject cash into the low-income sector serves its purpose of stimulating local spending. Another is to help local small and medium enterprises access loans to start them reinvesting in the country as commercial banks become stricter lenders. And the government needs to start long-awaited major infrastructure projects – the dual-track railway lines, transportation networks and water infrastructure that business leaders hope will help reignite foreign investment.

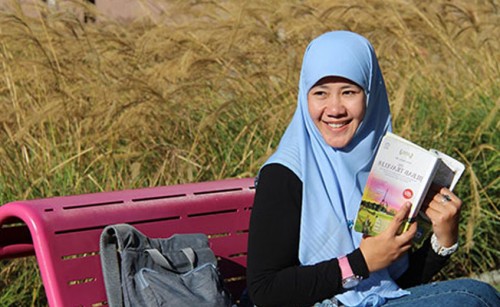

But Thailand’s ailments go far beyond the current economy. The demographic structure is undergoing a major transformation, where an ageing population will slowly outnumber the young population and squeeze the workforce.

“The birth rate is decreasing to less than 1 per cent, and it is expected that the population of the country will no longer increase,” Mr Taweelarp said. “The question and challenges for companies will be what they are going to sell to ageing consumers and how they can find more customers.”

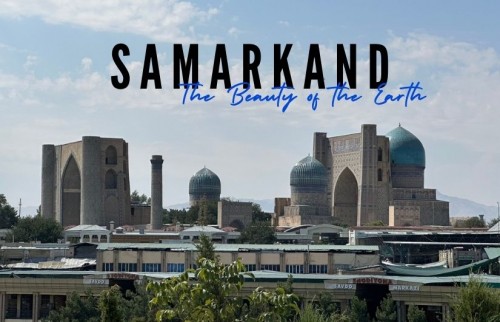

Thailand needs to embrace change on many levels. The world is entering “regionalization”, where countries within regional blocs trade with other member countries. Instead of exporting to usual distant trade partners, Thailand can access greater opportunities in the huge regional market of US$2.6 trillion and over 622 million people. In 2014, the AEC was collectively the third largest economy in Asia and the seventh largest in the world. “CLMV” countries – Cambodia, Laos, Myanmar and Vietnam, combined have 165 million people and impressive economic growth at around 7 per cent.

“Thailand stands to reap profits by trading with the AEC and CLMV. In the future, there will be increasing trade activities along the border and Thai companies will invest more in these neighbouring countries.”

The question is what is going to happen at the local level, when investment and factories move to neighbouring countries in the search for cheap labour. Inside the country is only an ageing population and a bear market.

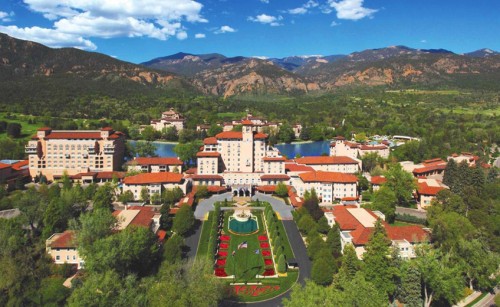

One positive aspect of Thailand remains its location in the centre of Southeast Asia, with access to China, India and southern peninsula countries Malaysia, Indonesia and Singapore. The prime location can help entice more people to live in the country, adding diversity to the existing 65 million people.

“Thailand can become a new residential area for foreign expatriates, investors and labourers. It can become a major tourism destination and that will be the way to enlarge our local consumer base.”

Location is a matter of luck. Mr Taweelarp thinks the country needs to improve productivity. Currently the government, businesses and society lag behind in terms of productivity compared to countries like Singapore and Malaysia. The country needs to improve skills and make more use of technology, innovation and online tools, and the government can speed up urbanization by building transportation infrastructure in major cities.

“People no longer have to live and work in Bangkok,” he said. “Major cities and Bangkok have grown more alike. In major cities we visit, we see condominiums and community malls where the middle class can work and live. States need to invest in infrastructure to create a bigger middle class.”

As economists and businesspeople know, a bigger middle class means more collective purchasing power.