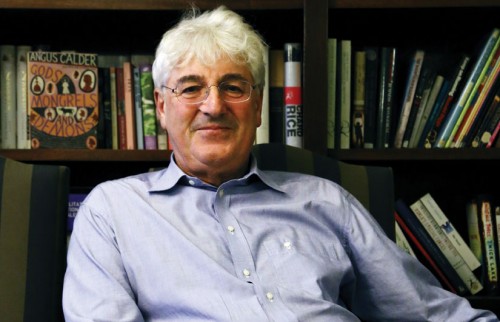

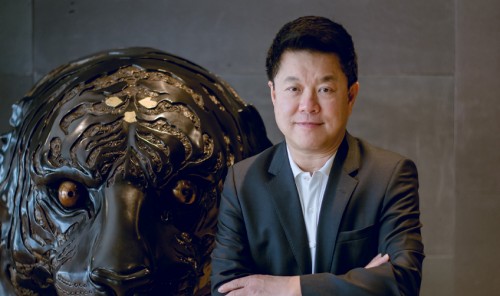

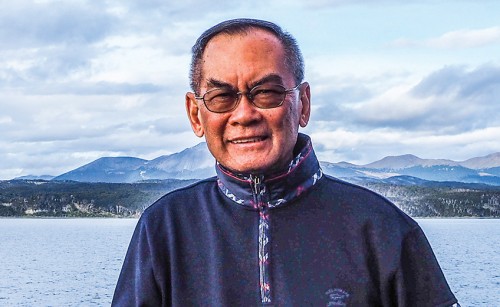

To begin, can you tell us about yourself and your educational background?

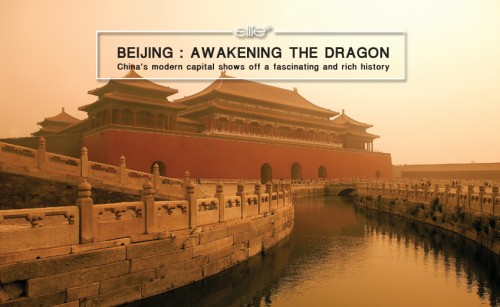

Similar to many Thai business families, my roots are Chinese. My grandfather emigrated from Fujian, China, with very little. Then, he and my grandmother, followed by my father and his siblings, built up our family business, beginning from a humble shoe factory.

Thus, I am a member of our family’s third generation to settle in Thailand. During my teen years, I was sent to boarding school in America. I then earned two Bachelor’s degrees in Chemical Engineering and Economics at MIT. Later, I enrolled in a Master in Chemical Engineering program at MIT, and once I completed this, I earned an MBA at Harvard Business School.

Once you had completed your studies, did you return to Thailand to work?

To be honest, I started working when I was still a teenager. I would come home to Thailand during my vacations, and my grandmother would assign me different tasks. During one of these stints, when working in the shoe factory laboratory, I became interested in chemistry and chemical engineering, and then watching how the business was run got me interested in economics.

But, to answer your question, no, I didn’t come right home. I went to work for Goldman Sachs, an investment banking firm in New York, when I finished my undergraduate studies and before returning to school to study for a Master’s degree. Then, after 12 years living and studying in the US, I returned to Thailand.

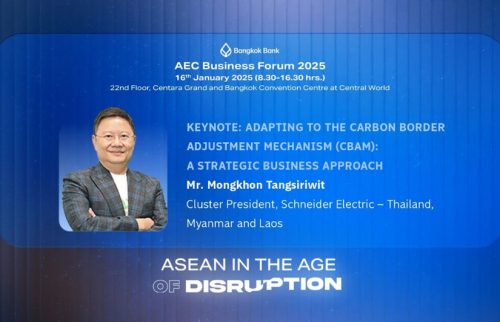

Again, I was very fortunate while I was at HBS, I met Mr. Chartsiri Sophonpanich, who was already the president of Bangkok Bank, and he asked me to join the bank. It was supposed to be for a short period; however, it ended up being well over a decade, and I still serve as a bank advisor.

Was it difficult to adjust once you returned to Thailand?

Not at all, I think, because I also had brothers and sisters in the States, and we lived together. Strangely enough, despite spending a long time in the US, most of my best friends were Thai. At that time, I came back to Thailand every summer, though it was not just for fun; I also worked, but this meant I didn’t experience much of an adjustment when I returned.

As you studied chemical engineering, how did you end up in banking and finance?

You know, I have conducted thousands of interviews of applicants applying for jobs at the bank, and I found when choosing between people with a financial, economic, or engineering background to do financial analysis, I would prefer someone with an engineering background.

It might surprise you that so many of the top finance gurus in Thailand have an engineering background. Engineering helps to develop analytical skills, systematic thinking and problem-solving ability. They can also be quite creative in their approach. As far as what’s required in accounting, corporate finance and macroeconomics, you can always have a person take extra courses or learn those on the job.

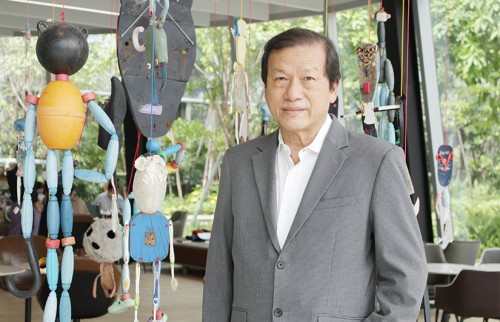

After working at Bangkok Bank for 13 years, was it difficult to leave to join your family business?

Yes, it was a difficult decision because I was enjoying myself. I was learning a lot. My responsibilities were to work with clients nationwide, and I worked closely with a lot of different people. However, you must also understand that I always planned to join the family and never expected to stay for so long with Bangkok Bank.

While many family businesses face problems when future generations are not ready to return, my grandmother had planned for this eventuality. She developed a constitution system upon which we operate. I was also lucky, as I had worked in our family business in some aspect since I was 16, and there was a common understanding that one day, I would join my family business as a member of the next generation.

What differences have you experienced working for a public listed company and a family business?

There are differences, and I would say there are both pros and cons working for each. The goals of family-run businesses tend to be more long-term and a bit more conservative. There also seems to be a greater concern for the people, as they are like family. In the corporate world, you can discuss anything without worrying that you may offend someone.

Things are also much more black and white in the corporate world, whereas in a family business, relationships are bound to be more sensitive. As for my family business, after adjusting everyone’s mindset, they have been able to see the positive side of implementing corporate professionalism into our organization. We now have a good board, and not all of the managing directors of our different enterprises are family members. We have made it very clear that people are promoted according to their abilities and performance.

As an adviser for the Bualuang Club Small Medium Enterprise (BLCSME), you are developing courses in operating a family business. What does this entail?

At Bangkok Bank, we value developing long-term relationships with our customers. The BLCSME was established to assist family businesses. As we have seen the challenges many face, we have created courses to help the second and third generations working in their family business. One of our programmes, YBBL, or Young Bualuang Business Leader, is designed specifically for the second and third generations, aged between 25 and 35. At this age, these people have already gone back to work for the family business for a few years. We then teach them through case studies, just like when I studied at Harvard Business School, to illustrate how to resolve problems. We teach them how to prepare to become a leader and face challenges from both the business and family sides. On the business side, everything is changing very quickly due to technological advancements while on the family side, you can't find courses that will tell what to do if a family conflict erupts, how to resolve an issue. I started this program alongside another program, and have 90 classes in all, with more than 1,000 people, mostly bank customers, having already attended.

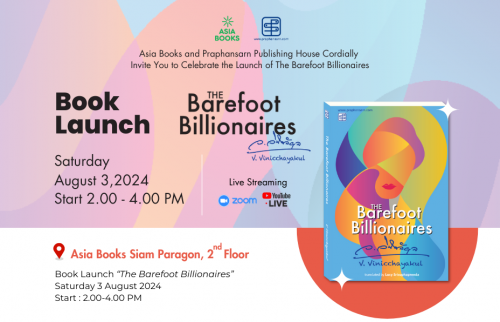

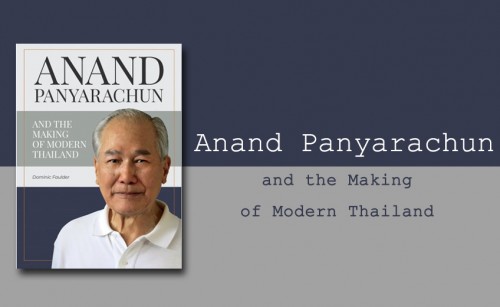

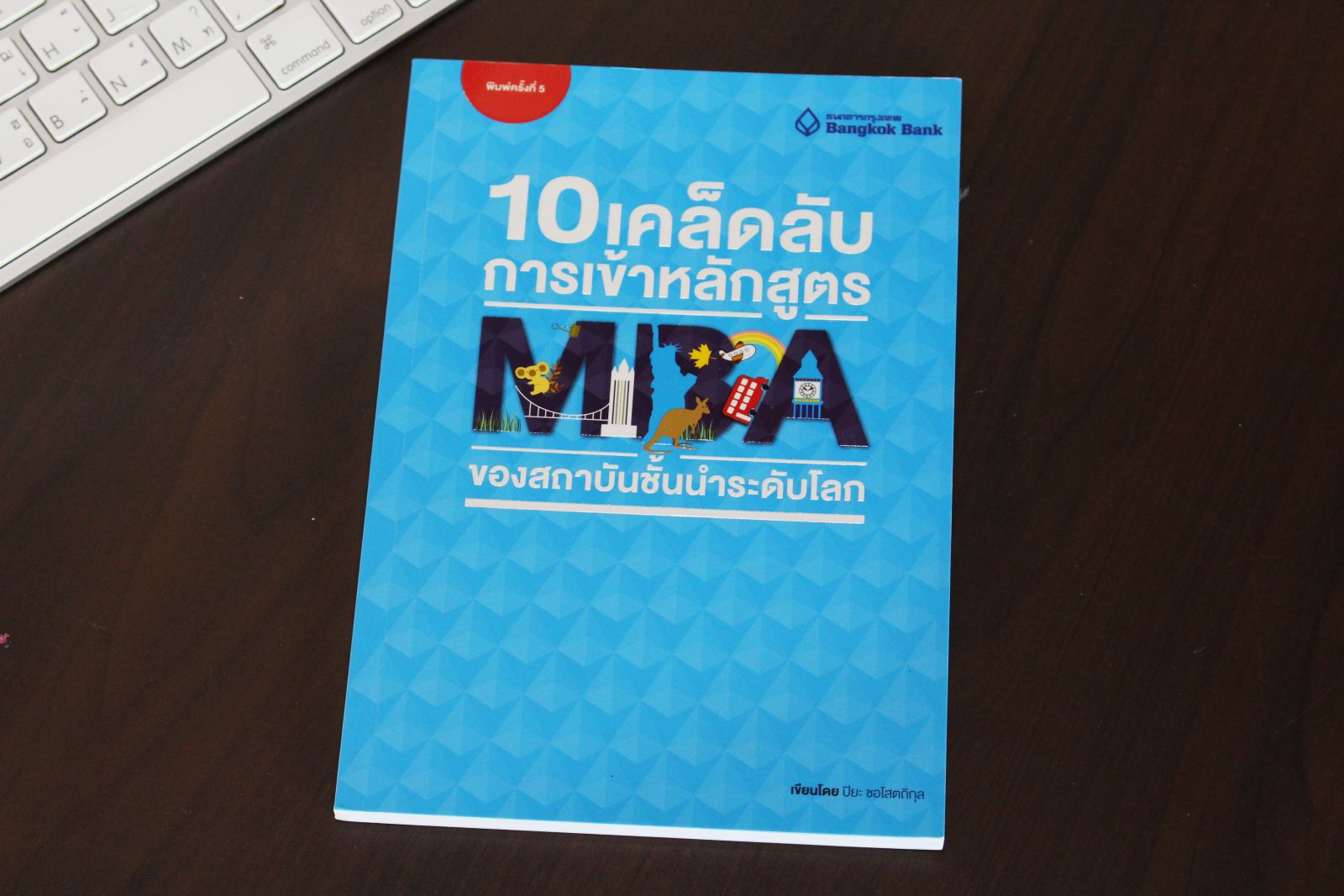

I understand you have written two books in Thai: 10 Commandments to sustain a family business and 10 Secrets to getting into a World-class MBA. While the first seems very relevant to what we have been discussing, the second seems very important for those looking to continue their studies. Can you tell us something about each?

Let me talk first about 10 Secrets to getting into a World-class MBA. I have always been very interested in education and believe that if Thai children can receive a good education at a leading institution, they will benefit the nation. When I was on a committee supervising Bangkok Bank scholarship students, I wrote 10 Secrets… to help them prepare and apply the strategy to be admitted to the right school.

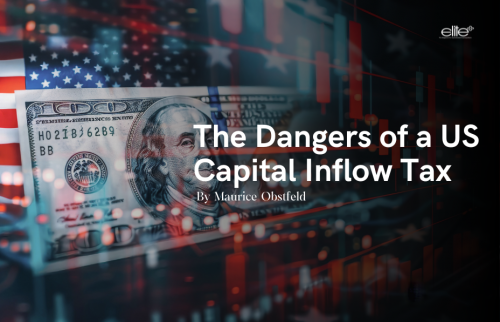

The second book, 10 Commandments to sustain a family business, can be applied to all family businesses. Let me give you a little bit of the background of this book. When I first came back to Thailand, I started working for Bangkok Bank in 1997, at the start of the “Tom Yum Kung” financial crisis when the baht was devalued. During my first few years on the job, I was involved with restructuring debt, working with companies having financial troubles, and the majority, if not all, were family businesses. I saw how each of those businesses, over time, had made mistakes. Unfortunately, some of them no longer exist. Not only that, throughout my career in banking, I was in the loan department. My last post was head of the provincial loan department. I had as many as 10,000 customers, and over the years, a number of these businesses have closed. In this position, I saw the common mistakes made by all the family businesses that went bankrupt and what they should have done. This is the reason why I wrote this book, to teach how to sustain a family business through five generations or longer, which less than three percent have managed to accomplish.

The whole book is actually about risk management: how to manage risks faced by a business. The concept behind these secrets is quite simple, the late King Bhumibol Adulyadej’s sufficiency economy. One of the commandments is "You should not expand the business too quickly," which covers investment risk. So, if sales seem to increase, but are not yet stable, factory expansion could actually be too soon, which leads to what we call "over expanding". This is what many real estate companies are now facing, and, as a result, they are performing poorly because they expanded too quickly. Then, there is the current Covid-19 pandemic, a very unexpected situation. Still, if a company has followed the guidelines offered in the book, they should be quite well prepared to handle current and future economic conditions.

Another commandment is "Do not go out of your specialties” so you won’t face over-diversification risk. To illustrate, my family business started as a shoe company. Then we expanded into food seasoning and then construction, shopping malls, hotels, and real estate. Many people might say that the early businesses fall under different sectors. Thus, we are not following this commandment, but actually, you can expand your businesses into a different industry than your original specialty, but only when you are ready. This means that the new businesses must start relatively small compared to your core business as your core business must have enough cash flow to support themselves and the new business if that the new company does not succeed.

Earlier you mentioned writing a family business constitution. Can you expand about this?

Working in a family business can be pretty sensitive; as I said earlier, it is not just black and white. In the corporate world, you don’t have to be so concerned about family members' feelings. A family council and constitution should be established to provide guidelines. These will not be legally binding but set the norms for behaviour and practice.

Suppose a family is facing the situation when the company founder is no longer there. In that case, it is very important to know the core beliefs of the family and how to mitigate potential problems and take care of family members. A constitution can do this, give direction to the board and a foundation for understanding among all family members. Family constitutions are becoming quite popular; many large family businesses in Thailand have their family constitution.

What are key factors for a successful business?

You must remember people run businesses. So, it would be best if you had the right people starting at the top. Successful companies need a good leader. A good leader is a person who has vision and is passionate about all they do. They need to engage with their people at all levels and value their contributions. They also need to lead by example, especially in the present when the world is changing so quickly. If a company has only a manager at the top, it could become challenging to make changes and adapt. But if the company has a leader, they will have someone who thinks innovatively and strives to implement changes.

Do you have advice for those of the younger generation who would like to be successful like you?

I think a lot of the younger generations are probably better than me. I try to seek their advice, especially in this digital era. They are much more tech-savvy and know a lot more than I do, like how to balance their lifestyle. They might also feel less of a commitment, but that's fine, as long as they don't become a burden to their family. Many of this new generation like to do start-ups, but after two or three years, I recommend they return to their mainstream business if they cannot succeed.

When you hand your family business to the next generation, how will you adapt and communicate with these family members?

In my family businesses, we have many different industries in the group. However, many family members also work elsewhere and do not plan to ever work for the family. The trick I teach in my course is getting them involved with the family business at an early age. I, myself, began to work in our shoe factory when I was 16. I worked as a stock keeper first and then as a salesman and went to different stores. In my third year, I worked in the shoe factory laboratory and, as I said, it was here I became interested in chemical engineering. I think this was my grandmother's secret to get me involved early. Then, I felt obligated and attached to the family business. So, the method is to get your kids involved with the family business at a very young age.

Any final thoughts to our readers?

If you are involved in business, the most important thing is to be agile, flexible, and adaptable. We have learned a lot from the pandemic. Everything and anything can happen, and it can occur very quickly. So, remember, if you are not agile or ready to adapt, your business might not be able to continue over the very long term.