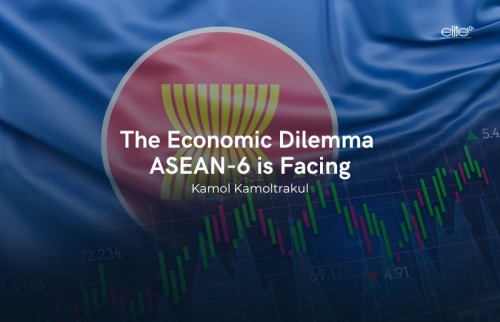

The anniversary of the 2014 coup d’etat passed quietly. But even quieter is Thailand’s economy. The Bank of Thailand cut its 2015 growth projection from 3.8% to slightly less than 3% based on weak exports. According to the Ministry of Commerce, exports continued to contract in June, dropping to 7.8% year-on-year. The more pressing question is not who to blame but what the national economy will look like in the future and what steps must be taken to prevent stagnation.

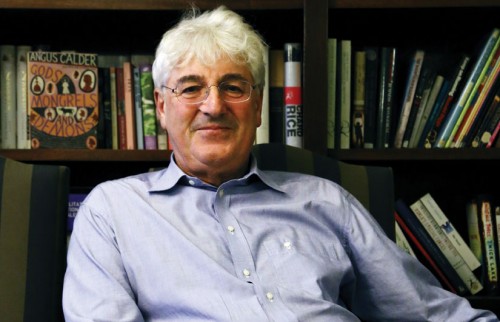

For Ulrich Zachau, economist at the World Bank, the economic downturn may linger longer than usual. The myth of “Teflon Thailand” – the national economy’s ability to bounce back from political turbulence – may not apply as the present decline is not part of a cyclical trend.

A lurking threat, he said, is that foreign manufacturers will look to neighbouring countries that have more competitive labour costs and a more skilled workforce.

“Thailand has been a hub of automotive assembly, and past growth has been made possible by the automotive sector,” he said. “But now some companies are talking about moving out to open plants with our competitors.”

The main problem, he thinks, is structural. This includes a shortage of skilled labour, caused by problems in education. It is not that Thailand does not invest enough in education. The percentage of the Thai budget allocated for education has been on par with OECD countries. But Thailand must have misplaced its investments in education.

Assoc Prof Panida, another speaker at the panel, believes the economy will remain sluggish for years. Most worrying is that Thailand may lose its export competitiveness for reasons other than a global downturn.

“At the same time, exports of Singapore surged 18%,” she said. “My question is how two countries that are so close and similar in terms of products perform so differently?”

In terms of exports and manufacturing, Thailand cannot do what Singapore did in creating more value-added export products, she said. Lack of skilled labour, innovation and technology are holding the country back.

Despite the gloomy prognosis, the experts believe Thailand’s geographic location, emerging middle class and influx of foreign workers from the ASEAN Economic Community (AEC) from next year will save the withering economy.

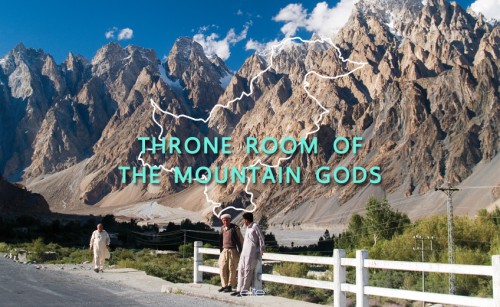

Mr Atikrai, who once worked with local energy company Padaeng Industry, believes the next frontier of Thai investment and business will be in the Mekong region, where investors can access a larger pool of potential consumers such as among the rising middle class in Vietnam, which has an appetite to consume and have what the Thai middle class has. “The landscape for investment now extends beyond Thai consumers,” he said.

First the government must solve more immediate problems. According to Mr Gisbourne, Thailand needs to keep foreign manufacturers from moving to the Philippines and Indonesia. “Foreign Direct Investment is going to be shared, but Thailand still has an opportunity provided by the sheer luck of geography,” he said.

The way to capitalise on the country’s location is by investing in infrastructure, such as railway links to help it become a logistics hub for the region.

To recover and grow sustainably, Mr Zachau urges Thailand to solve problems in its social fabric. A progressive tax is necessary to collect funds from the wealthy and create greater equality, along with a policy of diverting tax to improve education and health care. In terms of infrastructure, Thailand needs to expand internet bandwidth to make the internet faster and more accessible. Investing in transportation in urban areas is necessary, as it will help improve efficiency, reduce energy costs and attract foreign labour.