Trump’s Tariffs Are Hitting Home

There are two sides to a coin, and like Trump’s tariffs war that is severely affecting US trading partners, it is hitting the American market as well. Much of these tariffs came into effect at midnight, on the first of August, when the goods from more than 60 countries and the European Union were targeted with tariff rates of 20% and higher. Products from the European Union, Japan and South Korea are now being taxed at 15% while imports from Taiwan, Vietnam and Bangladesh are facing tariffs of as much as 20%. At the same time, the EU, Japan and South Korea are also expected to invest hundreds of billions of dollars in the US economy.

Despite the uncertainty being felt around the globe, the White House is confident that the onset of these broad tariffs will provide clarity for the world's largest economy. Now that companies understand the direction the US is headed, the administration believes they can ramp up new investments and jump-start hiring in ways that can rebalance the US economy as a manufacturing power.

However, economists have a different perspective. Generally, they agree that free trade increases economic output and income while conversely, trade barriers reduce economic production and earnings. Historical evidence shows that tariffs raise prices and reduce available quantities of goods and services. Such is the case for US businesses and consumers, who could be facing lower income, reduced employment and lower economic output.

Additionally, costs of tariffs are most often passed on to producers and consumers in the form of higher prices. Tariffs can raise the costs of parts and materials, which would raise the price of goods using these inputs, which can then mean less finished products. This would result in lower incomes for both business owners and their workers. Similarly, higher consumer prices due to tariffs will reduce the after-tax value of both labour and capital income. Because higher prices would reduce the returns to labour and investors, this would incentivise Americans to work and invest less, leading to further reduced output.

A study published by the National Bureau of Economic Research (NBER) conducted by Aaron Flaaen, Ali Hortacsu and Felix Tintelnot found that the complete burden of American tariffs will fall on US importers and consumers as there was no evidence that foreign exporters would lower their prices to absorb the tariff costs.

Hence, the effect of this tariff war will hit home as has already become evident in certain sectors such as automobiles. The tariffs have also recently raised prices in US supermarkets from consumer products to vegetables and fruit by up to 20%.

Thus, available evidence strongly suggests that Trump's tariffs are leading to higher prices for American consumers, with estimates of the average annual cost per household rising from roughly USD 1,200 to close to USD 5,000. Low-income families are expected to be hit hardest by these costs as they will eat up a larger proportion of their income.

Analysts at the Budget Lab at Yale University estimate the rise in annual costs per American household will be USD 2,400 per year while other analysts suggest an even higher figure of USD 3,800 annually, based on the short-term impact of a 2.3% increase in US prices due to the tariffs. Moreover, several independent estimates by organisations with varying political ideologies identified by PolitiFact range from USD 3,100 to USD 4,900 a year, with the average being around USD 4,000.

In another study published by the University of Chicago, Flaaen, Hortacsu and Tintelnot found that after the Trump administration imposed tariffs on washing machines, washer prices increased by USD 86 per unit and dryer prices increased by USD 92 per unit due to package deals, ultimately resulting in an annual aggregate increase in consumer costs of over USD 1.5 billion.

It is important to note that these figures are estimates and can vary based on several factors, including changes in tariff rates and the scope of the tariffs which Trump has frequently adjusted, impacting calculations. To accommodate these conditions, companies may try to absorb some costs or find alternative suppliers while consumers may alter their purchasing habits, according to Yale University’s Budget Lab.

Hence, once again, consumers will bear the costs of these tariffs. Previously, when Trump imposed tariffs, studies from the Federal Reserve, NBER and think tanks, like the Peterson Institute for International Economics (PIIE), consistently found that nearly the entire cost of the tariffs was passed on to US importers, leaving it for consumers to pay the added cost in higher prices.

According to the Tax Foundation, as of 10 April 2025, retaliatory tariffs are affecting USD 330 billion of US exports based on 2024 US import values. When current tariffs combined with threatened retaliatory tariffs are fully imposed, it is estimated that the US GDP could drop by 1.0%.

Alternatively, the US dollar may appreciate in response to tariffs, offsetting the potential price increase for US consumers. The more valuable the dollar, however, would make it more difficult for US exporters to sell their goods on the global market, resulting in still lower revenues for exporters. This would also result in lower US output and incomes for both workers and owners, reducing incentives for work and investment, which would lead to a smaller economy.

A study by David Autor and others for the IMF, concluded that tariffs failed to provide economic help to the US heartland while import tariffs had “neither a sizable nor significant effect on US employment in regions with newly‐protected sectors”, and foreign retaliation, “by contrast, had clear, negative employment impacts, particularly in agriculture.”

Business input costs have also increased significantly for manufacturers using steel, aluminium and Chinese components. Meanwhile, industry surveys on company earnings report US employment has experienced a net loss of an estimated 245,000 jobs. The NY Fed Reserve also reported that job gains in protected sectors outweighed losses in downstream industries.

In the agricultural sector, soybean exports to China fell by -75% and, thus, required USD 28 billion in federal aid to offset losses from retaliation. Overall, the U.S. trade deficit is increasing. While the US deficit with China fell, this was offset by increases with other countries,” the US Census Bureau said.

Though tariff revenue increased significantly (reaching USD 80 bil), it was far less than the cost of farm bailouts and economic drag, the Treasury Department said.

Hence, the overall consensus from economic researchers is that while the tariffs do provide some protection for specific, targeted industries, their overall effect will be a net negative for the US economy. The primary findings show the tariffs raise costs for both consumers and import-dependent businesses, resulting in job losses and retaliatory tariffs that have hurt US agricultural and manufacturing exporters.

However, Trump may achieve his political goal, making America great again, but most economists agree that the American consumers are the ones who will pay the price for his aspirations.

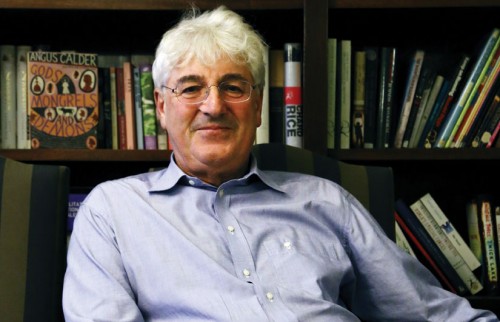

Kamol Kamoltrakul 48 Posts

Visiting lecturer: Navy Academy Institution, NIDA, School of Governor, Ministry of Interior, Chulalongkorn University, Former Lecturer, ABAC Honorary Advisor Trade and Industry Committee Senate. Senior advisor, Standing Committee on Finance and Banking, The House of Representative. Former Advisor to the Minister of Interior Board Member of ThaiPBS Board Member Of Thai Consumer Council Columnist : Prachachart Business Weekly, Matichon Weekly, Khom Chad Luke Daily Former Program Director Asian Forum for Human Rights and Development ( FORUM-ASIA).