Upgraded ASEAN-China FTA, A Game Changer

ASEAN is struggling to survive in the uncertain world economic order that reigned for the past 40 years before being broken by the US. The ASEAN China Free Trade Agreement 3.0, ACFTA 3.0, which will be signed in October 2025 is one of the strategies to escape the impact of the tariffs war being waged by US President Trump. Some analysts say it will be a game changer. The new pact focuses on digital and green economies as well as supply chain cooperation.

Signed in 2002, ACFTA was China’s first free trade agreement as well as ASEAN’s first with a major external partner. For Singapore alone, the deal eliminated tariffs on nearly 95% of exports to China while expanding market access.

ASEAN Secretary-General Kao Kim Hourn also lauded the upgrades in modernising the FTA between ASEAN and China, saying, this will open new doors in the digital and green economies along with supply chain connectivity as it redefines ASEAN-China economic relations through innovation and competitiveness.

“These agreements are not just about lowering tariffs; they are about building long-term resilience, enhancing economic integration and enabling our businesses to thrive in a rapidly evolving global environment, and I think it will remove a lot of inaccessibility for small and medium enterprises in terms of capabilities, knowledge and predictability."

Lucas Myers, a researcher affiliated with George Washington University’s Sigur Center for Asian Studies, said that the new ACFTA 3.0 provisions will carry both economic and geopolitical implications for China and its trade partners across Southeast Asia, especially as the US distances itself from regional trade frameworks. “With an absent US uninterested in free trade, China believes it can position itself as the defender of regional multilateralism and the existing trading system,” he added.

Myers told CNA, ACFTA 3.0 will deepen China-ASEAN relations, handing Beijing more leverage. In doing so, China can weaken US influence in Southeast Asia and ensure that it usurps the role traditionally played by Washington.

However, critics say it will end up being dominated by Chinese manufacturers in ‘New Age’ industries if ASEAN doesn't build domestic capabilities. The pact sends a strong political message, but critics have also urged caution as it is coming at a tricky, but opportune, time for overseas markets looking to de-risk slowly from the US.

While China’s share of ASEAN trade jumped from 12% in 2010 to around 20% by 2023, ASEAN’s imports from China have surged far faster than its exports there, widening the bloc’s trade deficit to over USD 190 billion. China’s market and capital are so disproportionately powerful that individual countries and their firms find it difficult to compete in a bilateral setting. There are concerns that ACFTA 3.0 will enable China to deepen this imbalance in its favour over time.

While some say the upgraded pact comes at the right time to strengthen the region’s integrated push, Southeast Asia will also need to tread carefully in managing concerns over Chinese industrial overcapacity spilling into the region. ASEAN member states are aware that there is a challenge to local industries from imported Chinese goods.

There are also those who believe the agreement lands at a timely, but delicate, moment, as Southeast Asia grapples with both a retreat by the US from global trade and the ripple effects of China’s export glut. There is doubt as to who stands to gain most from the upgraded deal. Much will depend on the fine print, and businesses across the region are watching closely to see whether ACFTA 3.0 can live up to expectations after two years and nine rounds of negotiations.

Myers signalled the risks to ASEAN’s companies and industries if Chinese firms come to dominate and crowd out smaller Southeast Asian businesses. “There are worrying signs that the deal's primary beneficiaries will be large Chinese firms that are already dominant in the FTA’s target sectors, like electric vehicles (BYD) and digital infrastructure (Huawei),” said Myers.

Smaller and less-developed economies, like Cambodia, Laos and Myanmar, do not stand to gain as much, Lee, the senior analyst from EIU, said. “They are at very early stages in terms of development and do not necessarily have very sophisticated exports that can go to China. But on the other hand, technology transfer, technical cooperation and assistance could prove very beneficial for those countries.”

“We also know that the Philippines does not have the best relations with China, and in terms of the economy, its goods and products do not necessarily gravitate toward areas Chinese consumers are particularly interested in. As it currently stands, the Philippines may not benefit a lot from ACFTA 3.0,” said Lee.

Anyway, there will be a real opportunity for Singapore and Malaysia to deepen their roles as hubs in the regional digital economy. Singapore has been one of the fastest growing countries in the region in terms of its digital economy. It has one of the fastest-growing exports of digitally deliverable services in the world, and China is one of its key partners. A lot of FinTech exports happen between Singapore and China. So it’s definitely an important area for both countries.

However, micro, small and medium enterprises (MSMEs) make up the backbone of ASEAN’s economy, but challenges on the ground still remain, especially for smaller firms and start-ups struggling to navigate complex regulatory environments. Simplified, streamlined processes and stronger, grassroots implementation will be critical going forward.

“Breaking that initial barrier of awareness and simplifying the process is really key,” said Lee, the Singaporean entrepreneur who also serves on an official MSME committee at the Singapore Business Federation.

Lee went on, “Practical, industry specific support from government or trade bodies is something that is very crucial, and if paperwork seems too daunting, you wouldn't want to incur any associated costs. But then you could miss out on the advantages.”

In conclusion, ACFTA 3.0 is a double-edged sword for ASEAN. It may be a game changer for some countries but ruin others, particularly their SMEs.

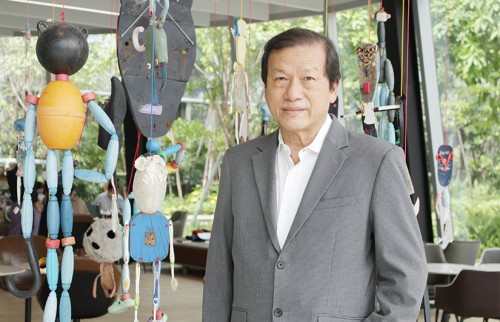

Kamol Kamoltrakul 48 Posts

Visiting lecturer: Navy Academy Institution, NIDA, School of Governor, Ministry of Interior, Chulalongkorn University, Former Lecturer, ABAC Honorary Advisor Trade and Industry Committee Senate. Senior advisor, Standing Committee on Finance and Banking, The House of Representative. Former Advisor to the Minister of Interior Board Member of ThaiPBS Board Member Of Thai Consumer Council Columnist : Prachachart Business Weekly, Matichon Weekly, Khom Chad Luke Daily Former Program Director Asian Forum for Human Rights and Development ( FORUM-ASIA).