‘BRICS Pay’ Could Reshape Global Finance

We now find ourselves in a competition between countries who support a multipolar world and an unipolar world dominated by the US. The competition doesn’t only concern economics, defence and politics, but also the global financial system. Recently, on the trade front, the US president said he is slapping an additional 100% tariff on imports from China and imposing export controls on all critical US-made software beginning 1 November.

Meanwhile, since the current global financial system is dominated by Washington, the BRICS bloc is working on setting up BRICS Pay, an alternative payment system designed to reduce dependence on the US dollar and SWIFT transaction system. BRICS Pay could foreshadow a new multipolar monetary architecture, although its full deployment still faces technical and political obstacles.

The American dollar has long been the world’s primary reserve currency, accounting for nearly 60% of global foreign exchange reserves as of 2024.

However, the growing influence of BRICS countries motivated to challenge the dominance of Western financial systems, particularly global reliance on the US dollar, may result in a new financial network that leaves Washington on the side-lines.

Hence, the BRICS Pay initiative, supported by the bloc expanded to ten countries, aims to reduce dependence on SWIFT and avoid US sanctions. It is a strategic bet to reshape the global monetary order and assert financial sovereignty in a world that has become multipolar. BRICS Pay is designed to enable transactions in local currencies between member countries of the bloc while bypassing the SWIFT network.

Many do not understand the importance of SWIFT, which was created by six international banks. SWIFT stands for Society for Worldwide Interbank Financial Telecommunication, and it is currently the international dominant payment mechanism. SWIFT is both a system and a Belgium based company that relies on its high security, payment monitoring and standardisation.

The international community has long adhered to this system, with more than 200 countries and over 11,000 institutions directly using the platform. An important SWIFT feature to keep in mind is that it is a communication system and not a bank, so institutions exchange messages through it, not money.

The idea of a functioning BRICS Pay independent payment system would be very relevant for independent financial sovereignty. The implementation of this financial mechanism could at least represent a safety measure against the pressure of the dominant United States and, at a maximum, become a channel for developing trade relations, including a related inter-BRICS trade project and, possibly, an alternative to the dollar currency.

Some experts have said that BRICS Pay would be an instrument of sovereignty against US sanctions as it could contest American financial hegemony. The strategic use of the dollar as a sanction lever, notably against Russia and Iran, has fuelled the desire of Global South countries to build a parallel network.

BRICS Pay is a proposed digital payment platform designed to facilitate cross-border transactions among member countries and serve as an alternative to the dominant SWIFT system, reducing reliance on the US dollar. BRICS Pay is expected to leverage blockchain technology, offering advantages like security, transparency and faster transaction processing.

The BRICS Pay initiative aims to escape reliance on US financial dominance. It is being designed as a decentralized cross-border financial messaging system that enables transactions between BRICS nations using their national currencies. This includes encryption, distributed consensus nodes, multi-factor authentication and the technical capacity to process up to 20,000 messages per second, explained one analyst.

Importantly, it will not require mandatory transaction fees and is being developed as an open-source protocol, ensuring that each country can run its own node while remaining interoperable with others. It also seeks to integrate various national platforms that already exist or are in development.

A prototype demonstration of BRICS Pay was showcased in Moscow in October 2024, marking a technical milestone in the project’s progress. Despite this, as of mid-2025, the system remains in its planning and early pilot stages, with hopes for broader operational deployment by the end of this year or into 2026. Integration efforts are progressing slowly, with links between Russia’s SPFS and other countries only partially implemented. Much work is still needed on standardised messaging protocols and cybersecurity frameworks.

BRICS Pay also faces challenges, like technical integration with existing systems, managing currency fluctuations and geopolitical tensions. Despite this solid foundation, no unified or fully functional version of the system has yet emerged. Russia’s SPFS and China’s CIPS serve as main alternatives to SWIFT. China’s digital yuan and Brazil’s digital real suggest a move toward blockchain-based settlements, which could be incorporated into the BRICS Pay framework.

In addition, deep disparities in financial regulation, capital mobility anti-money laundering rules and political trust among member states continue to obstruct meaningful progress. Analysts point to several major challenges that make a unified BRICS currency impractical in the near term.

Even if these technical and political challenges are overcome, BRICS Pay still faces the massive hurdle of confronting the entrenched dominance of the US dollar. The dollar is not only the world’s most used currency for trade and reserves, but it is also embedded in institutional stability and liquid capital markets that BRICS countries currently lack.

There is no unified monetary policy among non-Western countries, no shared capital market and no single central bank capable of underwriting a collective BRICS financial system like the Federal Reserve backs the American financial ecosystem.

Moreover, most BRICS currencies are not freely convertible, and their markets lack the deep liquidity needed for large-scale international trade, unlike the US dollar. Furthermore, the bloc includes countries with significant economic differences in terms of growth rates, inflation and development levels. Therefore, it would be extremely difficult to set a single monetary policy that works for all members.

In addition, there are political differences. BRICS members have varied and, at times, conflicting economic and geopolitical interests. For instance, India is wary of China's growing influence and potential dominance over a shared currency.

However, the response from President Trump has indicated that the threat of BRICS Pay is seriously concerning. President Trump has issued multiple threats of punitive tariffs and economic sanctions aimed directly at BRICS members participating in what he calls “anti-American” currency or payment initiatives. So, the world will just have to wait to see how things will progress.

Photo: Isabela Castilho / BRICS Brasil

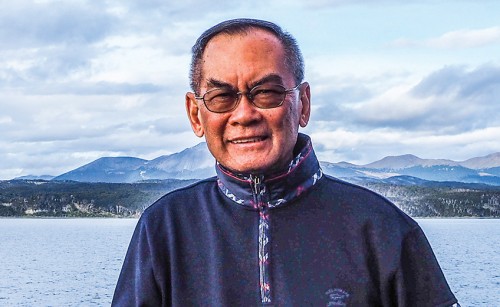

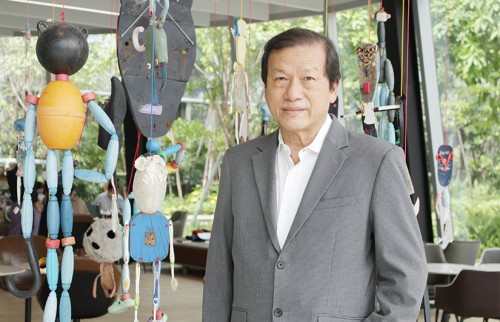

Kamol Kamoltrakul 48 Posts

Visiting lecturer: Navy Academy Institution, NIDA, School of Governor, Ministry of Interior, Chulalongkorn University, Former Lecturer, ABAC Honorary Advisor Trade and Industry Committee Senate. Senior advisor, Standing Committee on Finance and Banking, The House of Representative. Former Advisor to the Minister of Interior Board Member of ThaiPBS Board Member Of Thai Consumer Council Columnist : Prachachart Business Weekly, Matichon Weekly, Khom Chad Luke Daily Former Program Director Asian Forum for Human Rights and Development ( FORUM-ASIA).