Bangkok Bank and Hua Seng Heng launch the Hua Seng Heng USD Gold Trade app for trading gold in USD to minimize foreign exchange risk and provide convenience and will waive the gold trade fee until June 30, 2024

Bangkok Bank and Hua Seng Heng extended its business partnership by developing an application for real time gold trading in USD currency to minimize foreign exchange risk. The minimum investment is just 0.1 troy ounce. Opening an account is convenient via a mobile app, with no transaction fees charged from November 20, 2023 to June 30, 2024.

Bangkok Bank Senior Executive Vice President Chansak Fuangfu revealed that Bangkok Bank and Hua Seng Heng Group, a leader in the gold market, have collaborated together to create different platforms for gold investment, particularly the Hua Seng Heng USD Gold Trade platform which for the first time in Thailand provides a channel for investment of 99.99% pure spot gold in USD through a Bangkok Bank foreign exchange deposit account (FCD). The investment uses gold reference prices from live gold spot prices to reduce foreign exchange risk as there is no need for currency conversion into baht in every trade. The service provides cost efficiency and convenience through online transactions via the Hua Seng Heng website and has received overwhelmingly positive feedback from investors.

In the latest collaboration, Bangkok Bank and Hua Seng Heng Group have launched the Hua Seng Heng USD Gold Trade application to provide further convenience for online investing in 99.99% pure gold bars, with more investment options for each gold trade. The range for each investment has been increased from 1-100 troy ounce per trade to between 0.1 - 200 troy ounce per trade (equivalent to around 7,000 baht – 13 million baht depending on the current gold price). In addition, customers can sell parts of their gold from previous transactions which makes it easier to conveniently manage their investment. A newly added feature from Hua Seng Heng enables customers trading gold via the app to withdraw gold from their portfolio for 99.99% pure gold coins instead of cash.

“This service reflects the strong collaboration between Bangkok Bank and Hua Seng Heng Group who have worked together for many years, prioritizing the needs of customers. Gold investment services have been made available through foreign currency deposit accounts to help reduce the fluctuations in the value of the baht. They have worked together to develop more investment options, fewer restrictions, and a new platform with greater convenience as a “trusted partner” who is ready to stand by and advise customers on all financial matters at all times,” said Mr. Chansak.

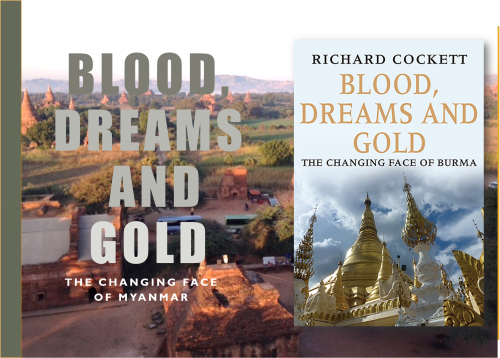

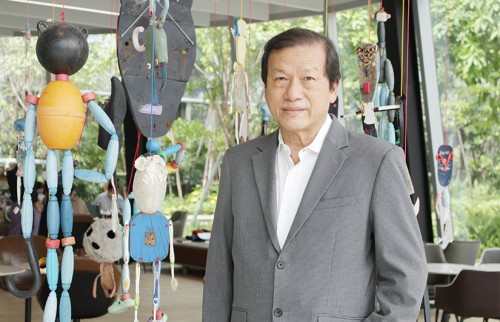

Mr. Thanarat Pasawong Chief Executive Officer of Hua Seng Heng Group said that: “Investing in gold has attracted more attention recently due to geopolitical conflicts, as well as economic and financial factors such as inflation and monetary policies that affect every country. Many investors have turned to investing in gold to diversify risk in their investment portfolios. In addition, the period covering the last and first quarters of the year is usually a time when the price of gold tends to increase due to seasonal demand in Asia. However, exchange rate fluctuations may mean returns from investing in gold are not as high as expected”.

“We estimate that the long-term trend of gold prices is still upwards. This year, the price of gold bars sold by the Gold Traders Association reached an all-time high of 34,250 baht due to the weak baht. Next year, since the baht is likely to strengthen and the US dollar may reverse its downward trend, investors should be wary of the effects of currency fluctuations. Buying and selling gold in US dollars will help reduce this risk and make investing in gold even more attractive. Recognizing this trend, Hua Seng Heng Group and Bangkok Bank have jointly developed the Hua Seng Heng USD Gold Trade application to increase options for investors. Customers can now quickly and conveniently open a foreign currency deposit account with Bangkok Bank without having to go to a bank branch. This suits the behavior of the young generation who are constantly following investment news from around the world,” said Mr. Thanarat.

To mark the launch of the Hua Seng Heng USD Gold Trade platform, Bangkok Bank and Hua Seng Heng Group will waive the service fees for gold trading via the application from November 20, 2023 to June 30, 2024.

Those interested in investing in gold in USD currency can do so in 3 easy steps:

1.) Download the Hua Seng Heng USD Gold Trade application via Apple Store or Google Play Store and register to open a gold trading account.

2.) Open an FCD e-Savings account in USD currency via Bangkok Bank Mobile Banking.

3.) Link the FCD e-Savings account with the gold trading account via the Hua Seng Heng USD Gold Trade application and you can enjoy investing in gold instantly. For more information, please contact Bangkok Bank Call Center 1333 or 0-2645-5555 or visit us at www.bangkokbank.com.